By Ricks Kayizzi and Sarah Nabakooza

Uganda’s coffee exports have continued to go on an upward trajectory, rising in both value and volume in the month of August.

According to the Uganda Coffee Development Authority (UCDA), a total of 837,915 60kg bags of coffee, valued at $221.63m (sh819.03b), were exported in August this year.

This is a 5.3% increase from the July revenues of $210.48m (sh795b) from 821,593 60kg bags.

The August exports comprised 785,667 bags of Robusta, valued at $208.14m (sh769.12b) and 52,248 bags of Arabica, worth $13.49m (sh49.91b).

Compared to the same month last year, this marked a 13.15% increase in quantity and an 82.98% rise in value, according to the coffee authority.

The coffee was exported at an average price of $4.41(sh16,317) per kilogramme, with sustainable Arabica coffee fetching the highest price at $5.58 (sh20,646) per kilogramme.

In August last year, Robusta coffee saw a 14.33% increase in quantity and an 87.38% increase in value, while Arabica exports dropped by 2.01% in quantity, but rose by 34.33% in value.

The lower Arabica export figures were attributed to a smaller harvest in the Elgon region, driven by the bi-annual off-year cycle and poor flowering conditions.

UCDA managing director Dr Emmanuel Iyamulemye attributed the rise in the value of Robusta coffee to an increase in the demand for the coffee type.

“Arabica coffee, known for its superior flavour, has faced supply constraints, due to climate issues in Brazil and other growing regions, which has resulted in higher prices for Arabica beans, prompting roasters and consumers to turn to the more affordable Robusta variety,” he said.

Iyamulemye added that the rise in instant coffee production, which often utilises Robusta beans, has contributed to this increased demand, particularly in markets, such as Asia and Africa.

The higher export value reflects the continued rise in global coffee prices, spurred by concerns over dry conditions in Brazil and Vietnam, which are expected to affect yields, potentially leading to a supply deficit in the 2024/25 season.

Europe remained the largest destination for Uganda’s coffee, with Italy maintaining the highest market share at 35.37%, although this has gone down from 40.68% registered in July this year.

It was followed by Germany, with 20.83% (up from 15.75%), India at 7.08% (up from 5.26%), Sudan at 5.43% (up from 5.41%) and the Netherlands at 4.94% (up from 4.14%).

Uganda’s coffee exports to African countries were 101,562 60kg bags, representing a 12% of the total coffee consumed in Africa.

This is, however, a reduction from 112,713 bags or 14% of the coffee supplied to Africa in the previous month.

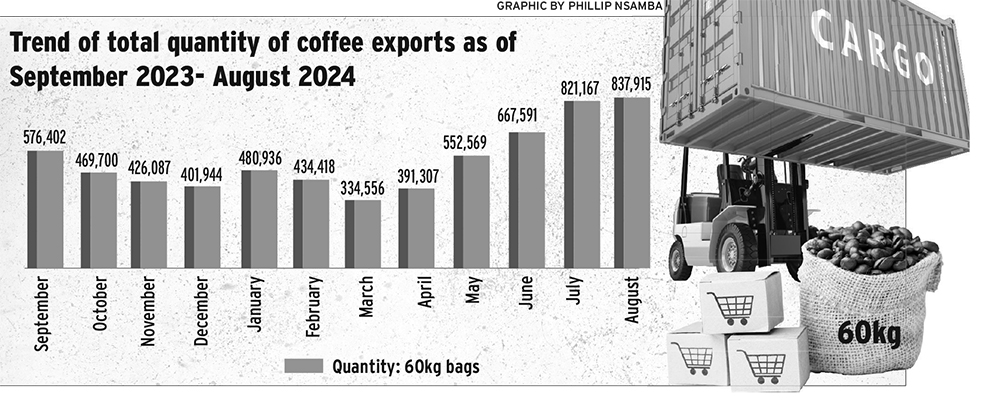

Over the 12-month period from September last year to August this year, Uganda exported a total of 6.39 million bags of coffee valued at $1.35b (sh4.995 trillion) globally.

Iyamulemye explained that the reason for the price increase is the surge in coffee consumption, citing the US Department of Agriculture’s June 2024 coffee report, which projects that consumption levels are expected to reach record highs. In 2024/25 alone, there was a rise in consumption of 3.1 million bags, bringing the total consumption to 170.6 million bags.

“To sustain this market value, UCDA has implemented systems to ensure coffee quality, emphasising good agricultural practices, proper harvest, post-harvest handling and certification for export that meets international standards,” he said.

EU regulations

On the effects of the European Union Deforestation Regulation (EUDR), which requires coffee producers to prove that their coffee is not sourced from deforested land after December 31, 2020, Iyamulemye said compliance will necessitate detailed traceability systems, geo-location data and audits, leading to increased production costs.

“These costs are likely to be passed on to exporters, roasters and ultimately consumers, resulting in higher coffee prices,” he explained.

Butambala County MP Muhammad Muwanga Kivumbi appreciated UCDA’s move to register coffee farmers, saying it will enable buyers to trace coffee back to its source.

Dr Augustus Nuwagaba, an international consultant on economic transformation, recently agreed that Uganda’s coffee sector is thriving, largely due to improvements in quality control.

“We are now ranked third, globally in coffee quality. This is because of the stringent enforcement of good practices and farmers are harvesting only ripe, red beans, drying them properly and ensuring the coffee is free from foreign matter, such as stones,” Nuwagaba explained.